The French shareholder revolution

I recently stumbled on a new and innovative capital structure that, as far as I can tell, only exists in France.

Since 2011, French beauty giant L'Oréal has been rewarding long-term investors with a loyalty bonus. It goes like this: if you buy L'Oréal shares, register them before the end of 2016, and hold them till 2019, you'll start to enjoy a 10% dividend bonus come January 1, 2019. So if L'Oréal declares a dividend of €1.00 in 2019, anyone who has held since 2016 gets €1.10. Not bad, eh?

Think of this as an obligatory transfer payment from short-term L'Oréal shareholders to long-term ones. Put differently, if you want to speculate in L'Oréal shares, expect to pay investors a fee, or tax, for that luxury. Unlike most taxes, this one hasn't been instituted by the government. Rather, it's the corporation that is decreeing this particular redistribution of income.

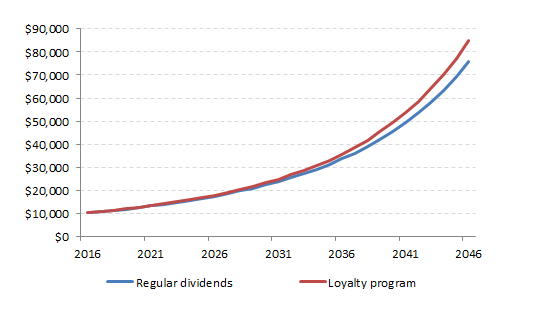

How big is the tax? Let's imagine an investment of $10,000 in the shares of a company that consistently appreciates 5% each year and increases its dividend by 5%. The dividend yield is 2% and all dividends are re-invested.

|

| Fig 1: Comparative return from investing $10,000 in a firm that offers a loyalty bonus program |

Assuming no loyalty dividend, the initial stake will be worth $79,851 upon retirement thirty years later. However, if the shares are registered in the 10% loyalty program for the entire period then the stake grows to $84,851. See figure above. The patient investor who takes the second option is 6.3% richer thanks to the premium. Tens of thousands of impatient speculators over that thirty year period will have effectively provided the patient investor with this boost to their wealth, most of these speculators probably not even aware of the subsidy they are providing. That's the magic of compound loyalty dividends! Note: By playing with the assumptions, say by making dividends grow at a faster rate (7%) than the share price (3%), the final wealth differential can be as high as 11.8%.

The loyalty dividend structure, otherwise known as prime de fidélité in French, goes back to 1993 when Groupe SEB, a French appliance manufacturer, adopted it. That same year it was copied by industrial gas giant Air Liquide, Siparex, and De Dietrich (which went private in the early 2000s). Despite ensuing controversy in the French legislature over the fairness of elevating one class of shareholder above the rest, the ability to provide prime de fidélité was enshrined in French law in 1994, with several limits.

These limits include: 1) Shareholders must hold for at least two years; 2) The bonus cannot exceed 10% i.e. if the regular dividend is €1.00, nothing over €1.10 can be paid, and; 3) If a given shareholder owns, say, 10% of the company, they can only earn a bonus on the first 0.5% of that, the other 9.5% qualifying for the regular dividend.

After the first wave of adoption, the prime de fidélité structure was largely ignored by French firms, the exception being concrete giant Lafarge which began paying a loyalty dividend in 1999. But post credit-crisis, the idea has found a second wind. L'Oreal votde to institute a prime de fidélité in 2009; Credit Agricole, Energie de France, and Sodexo did so in 2011; and GDF Suez and Albioma in 2014. These are not small companies. Five of them—Lafarge, GDF, EDF, Credit Agricole, and Lafarge—are in the CAC 40, France's bellwether equity index.

I'm a fan of the prime de fidélité structure. If firms want to encourage an investing mentality among their shareholder base, setting up an an incentive mechanism like a loyalty bonus scheme seems a good way to go about it. Shareholders who are incentivized to think in terms of the long game will be more likely to elect a board of directors with that same mindset, the board in turn exerting pressure on management to adopt long-term goals. Even better would be a version of this program that allows investors to begin enjoying loyalty dividends from the moment they buy shares, say by giving new shareholders the option to lock-up their shares for a fixed two year term in return for a reward.

--------------

Addendum: All of this ties into a favorite topic of mine. The world is missing a key financial product that I like to call the equity deposit. Indexed ETFs and mutual funds allow for immediate or end of day redemption, but this sort of uber-liquidity simply isn't required by the large population of passive equity investors who expect to hold till retirement.

To buy these indexed equity deposits, investors would be required to lock-in their investment for, say, ten years, with redemption only possible upon maturity. With captive funds in hand, the manager of the equity deposit scheme would be able to move a large percentage of the fund's assets out of unregistered shares and into registered loyalty programs. Mutual funds and ETFs, which offer instant or end of day redemption, need to stay relatively liquid in order to meet potential redemption requests. Putting shares into registered share programs like L'Oréal's would introduce liquidity risk, so mutual funds and ETFs would probably only be able to make limited usage of loyalty programs.

Equity deposits would thus be able to lever the magic of compound loyalty dividends to provide those with long-term goals a higher return than an equivalent index mutual fund or ETF. After all, if your plan is to buy once in your thirties and sell once in your sixties, why waste money paying for all the liquidity services that come in between?

0 Response to "The French shareholder revolution"

Posting Komentar